The Church Finance Corporation facilitates growth of Christian ministries by providing financial and related services and investment opportunities. We offers a variety of services, including lending, investments, consulting and events.

Our Team

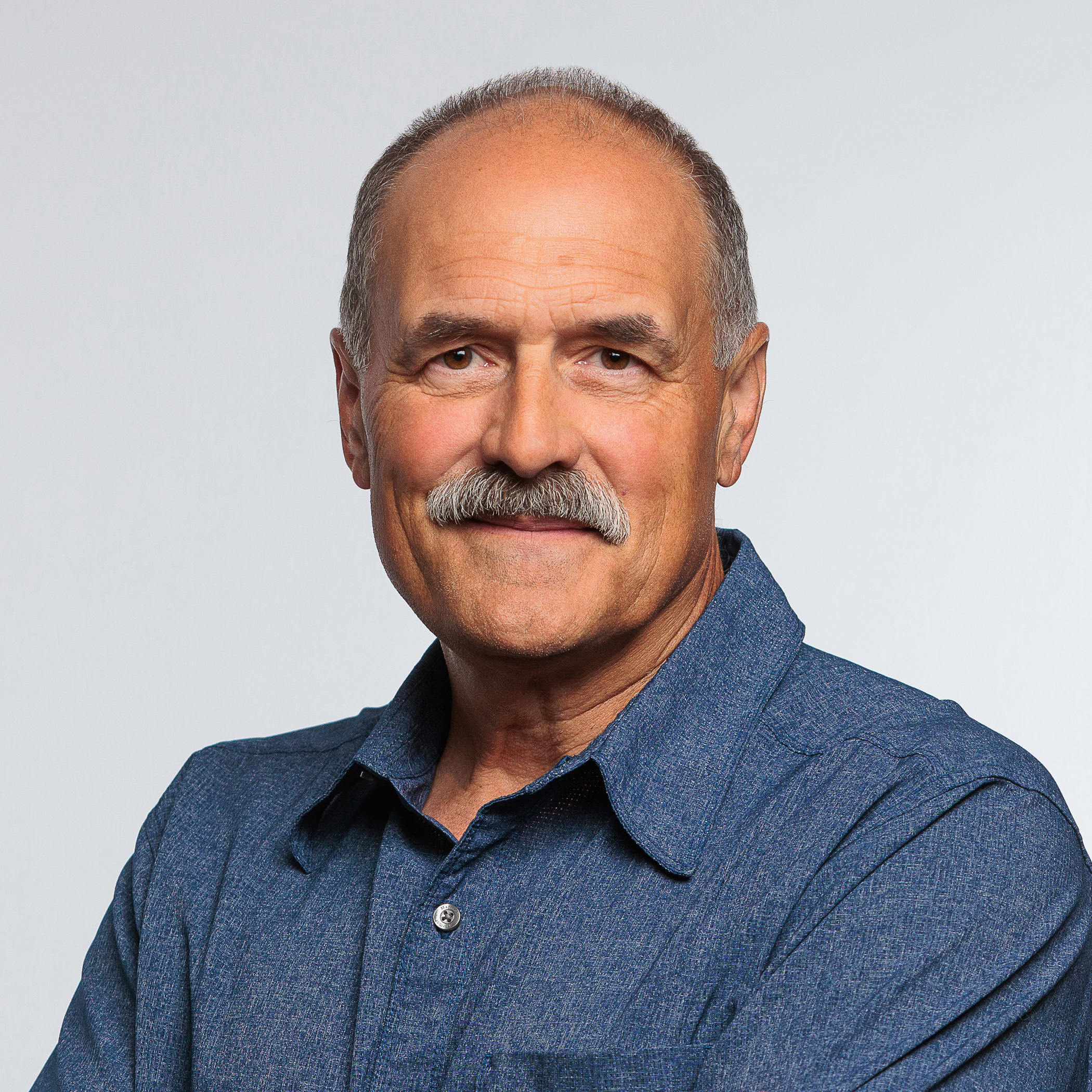

Rick Breeden

President

Barb Mulvey

Chief Financial Officer

Jeff Watson

Chief Lending Officer

Trey Waring

Vice President of Lending

Elizabeth Allan

Dir. of Employee Engagement

Micheal Summers

Development Officer

D’Ann Craft

Accountant

Betty Babicz

CFC Treasurer

Melanie Meis

CFC Accountant